Entering the world of cryptocurrency can be an overwhelming yet thrilling endeavor, laden with opportunities and risks. As a Canadian enthusiast in this digital financial realm, finding the right platform for trading crypto has been a quest that has led me to explore numerous options. Among the many available exchanges, Newton has emerged as my primary go-to platform for engaging in the exciting realm of digital assets.

My decision to use Newton wasn't hasty. It stemmed from a thorough evaluation of various platforms' offerings, as well as a keen understanding of what I sought in a cryptocurrency exchange. As a now regular user of Newton, I've encountered a multitude of reasons why this Canadian-based exchange has become an instrumental tool in my crypto journey.

One of the primary reasons I gravitated towards Newton was its simple and user-friendly interface. Newton's platform simplifies the buying, selling, and transferring process, providing an intuitive and streamlined user experience without any unnecessary clutter. The clean design and accessibility of essential features have made the onboarding process a smooth and enjoyable experience for me. Its simplicity allows for quick and easy transactions, making it an appealing option for beginners and experienced traders alike.

Speed and reliability are essential in the fast-paced world of cryptocurrency trading, and Newton excels in these areas. Transactions are processed fairly, swiftly, and efficiently, eliminating potential delays that could affect trading outcomes. The platform's reliability, coupled with the seamless execution of transactions, has been instrumental in optimizing my trading experiences. It has afforded me the ability to capitalize on major market movements swiftly, a crucial aspect in the volatile realm of cryptocurrencies.

Security has always been a paramount concern when it comes to managing digital assets, and Newton takes this aspect seriously. The platform is built for crypto’s unique risks with security measures such as recurring penetration testing and cold storage for the majority of their assets; 80% of Newton’s assets are kept offline to limit their exposure to unforeseen issues and risks. This provides a sense of assurance and trust in the platform. However, it's worth noting that while the security measures are reassuring, Newton's status as a relatively new exchange in the market brings about an initial level of caution, despite the confidence instilled by these security protocols.

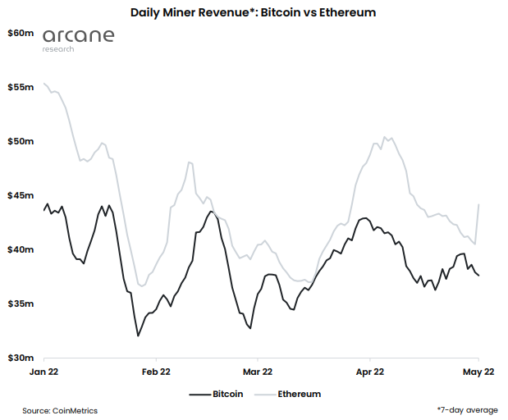

The variety of available digital assets for trading is another area where Newton has performed well. While it may not boast the most extensive selection of cryptocurrencies, it offers a diverse range, including prominent assets like Bitcoin, Ethereum, Solana, and others. This diversity provides ample opportunities for traders to explore and diversify their portfolios within the crypto ecosystem.

In my journey as a cryptocurrency enthusiast, Newton's 24/7 customer support has played a pivotal role in my overall experience. The responsiveness and helpfulness of the support team have been commendable, providing timely assistance whenever any questions or concerns arise.

Newton has been a welcoming entry point for many Canadians venturing into the crypto space, offering a secure and user-friendly platform. Despite its numerous merits, Newton, like any platform, is not without its drawbacks. In the following sections, I will delve deeper into both the advantages and limitations of Newton as an exchange, offering a comprehensive evaluation of its place in the Canadian crypto landscape. Additionally, I'll explore how a forex platform, Global Prime, may excel and be the preferred choice for specific trading needs.

Why I Use Newton to Buy and Sell Crypto

My journey into the world of cryptocurrencies led me to Newton, a Canadian-based exchange that has become my preferred platform for trading digital currencies. Newton's appeal stems from a combination of factors, most notably its user-friendly interface and the seamless trading experience it offers. Upon entering the realm of crypto trading, the sheer complexity of different platforms, digital assets, and market intricacies can be intimidating. Newton's user-friendly design and ease of use immediately stood out to me. In this ever-evolving landscape, the platform's simple layout is a breath of fresh air. It streamlines the process of buying, selling, and managing digital assets, providing an accessible gateway that is able to serve the needs of novices and veterans equally well.

Efficiency and Reliability of Transactions

The speed and reliability of transactions are pivotal aspects that contribute to a positive trading experience, and Newton excels in this domain. Transaction processing on the platform is rapid and dependable, eliminating potential lags or delays that might hinder effective trading. The platform's swift and efficient transaction execution has been crucial in seizing market opportunities promptly and responding to fast-paced market fluctuations, an integral part of successful cryptocurrency trading. Funding a Newton account via Interac e-Transfer from a connected Canadian bank account is quick and efficient. Withdrawing funds to a Canadian bank account is equally easy.

Commitment to Security

Security is a top priority when dealing with digital assets, and Newton addresses this concern by implementing several robust security measures. Consumer facing features such as mandatory two-factor authentication and corporate measures such as insured assets, institutional grade storage, as well as an in-house data security team add layers of protection to users' funds, instilling confidence in the platform's security protocols.

Access to the Most Relevant Digital Assets

While Newton might not offer the most extensive selection of cryptocurrencies, it boasts a diverse range of digital assets, including major players like Bitcoin, Ethereum, and Solana, among many others. This variety caters to different trader preferences, allowing for opportunities to explore and diversify portfolios within the Newton ecosystem.

Responsive Customer Support

In my experience, Newton's customer support team has been a valuable resource. Available around the clock, their responsiveness and assistance in resolving queries or issues have contributed to a smooth and reassuring trading experience.

My utilization of Newton for buying and selling cryptocurrencies has been underpinned by these standout features. It's important to recognize that while Newton exhibits multiple strengths, it has its limitations, which I'll explore in the subsequent sections to provide a holistic overview of the platform's performance in the Canadian crypto landscape.

Why Global Prime is Better for Day Trading Crypto

Newton, as a cryptocurrency exchange, undoubtedly possesses numerous advantages that make it an attractive platform for trading digital assets. However, when specifically considering day trading in the realm of cryptocurrencies, another platform, Global Prime, shines brighter due to its specialized tools and features tailored specifically for this purpose.

Newton's user-friendly interface, fast transaction processing, security measures, and available cryptocurrencies make it a robust choice for general cryptocurrency trading. It excels in providing an accessible and secure environment for investors to buy, sell, and hold digital assets. Nevertheless, when it comes to the specific demands of day trading, certain features of Global Prime offer distinct advantages.

Introduction to Global Prime

Global Prime, as a forex broker, is much better suited for day trading cryptocurrencies due to its experience, specialized tools, and tailored services. Day trading requires particularly swift execution, access to in-depth market analysis, and tools for technical analysis, all of which are distinct offerings of Global Prime, setting it apart from platforms designed primarily for standard crypto trading through buying and selling assets.

Global Prime's Tools and Advantages

Day trading requires rapid decision-making and execution, and Global Prime fulfills these needs efficiently. With features like access to professional-grade charting tools, robust analytics, and faster execution times, the broker significantly enhances the overall day trading experience, allowing traders to swiftly capitalize on short-term market movements.

While Newton is a fantastic platform for general cryptocurrency trading, Global Prime's specialized tools and focus on the day trading niche provide a more tailored and advantageous environment for those who seek to actively trade cryptocurrencies throughout the day. Additionally, Global Prime offers all the usual advantages of a world-class forex broker such as extremely low spreads, low trading fees, and - maybe most importantly - leveraged trading through the use of a margin account.

In conclusion, both Newton and Global Prime serve distinct purposes in the cryptocurrency trading landscape. While Newton excels in providing a user-friendly interface and a secure environment for general trading, Global Prime emerges as a superior choice for day traders due to its specialized tools, low fees, and the ability to trade on margin. Understanding your individual trading preferences and needs is crucial in choosing the platform that best suits your trading objectives.

A Note on the Drawbacks of Newton

While Newton stands as a commendable platform for Canadian crypto traders, it's essential to recognize that, like any service, it does have some drawbacks, although fairly minor in nature. In any case, acknowledging these limitations is crucial for a well-rounded assessment and understanding of the platform's performance.

Newton's Relative Newness in the Market

One noticeable drawback of Newton is its relative newness in the market. As a relatively new player in the exchange landscape, Newton might not possess the same level of reputation and trust that more established platforms enjoy. However, this drawback can be mitigated by primarily relying on the platform for trading purposes, but not as a wallet or storage solution for holding digital currencies for extended periods of time.

One of the key conclusions from the various scandals involving large crypto exchanges throughout the last few years is to never keep digital assets in a custodial wallet longer than necessary. One of the best ways to mitigate the risks associated with bankruptcies and/or corrupt individuals is to always transfer crypto assets to a non-custodial wallet as soon as possible. This helps ensure that you and only you are in full control of your assets.

Limited Selection of Cryptocurrencies

Another limitation of Newton is its somewhat restricted range of available digital assets. While it does offer the most prominent cryptocurrencies, some users might find the selection to be narrower compared to larger exchanges. To overcome this drawback, Canadian individuals seeking a more diverse portfolio can utilize Newton exclusively for exchanging cryptocurrencies to/from fiat currencies (i.e., Canadian Dollars), and then transfer those assets to a non-custodial wallet that offers swaps. This approach makes it possible to obtain and store a much broader array of cryptocurrencies than what is available for trading directly on Newton.

Operates Only in Canada

Newton's exclusive operation within Canada could be perceived as a drawback for users who wish to access the platform from other regions. While this restricts its accessibility on a global scale, for Canadian users, this focus on a local market can also be seen as a positive aspect. However, for those outside Canada, the limited accessibility remains a constraint.

Lack of External Security Audit

Although Newton implements several robust security measures, including internal security audits, it hasn't yet undergone an external security audit. This might be a concern for users who place significant emphasis on independent third-party security assessments.

As mentioned previously, one very effective way to address most of these drawbacks is to view Newton only as a gateway for buying and selling cryptocurrencies rather than a storage solution for holding them. Utilizing the platform primarily for trading purposes and swiftly transferring assets to a non-custodial wallet can offer a more secure and diversified solution for managing digital assets. To support this strategy, Newton covers the first $5 of the transaction fee on the first withdrawal to a 3rd-party wallet made in a fixed 24-hour period. On the first withdrawal of the period, only transactional fees above $5 will be a cost incurred by the user. By taking advantage of this, users can benefit from Newton's strengths in trading while mitigating the drawbacks associated with the platform's newness, limited selection, and potential security concerns.

Conclusion

In the quest to traverse the dynamic landscape of cryptocurrencies, Canadian traders often seek a cost-effective, reliable, user-friendly, and secure platform to kickstart their digital asset journey. Newton has emerged as a prominent option, offering an array of commendable features that cater to the needs of both novices and seasoned traders. Nevertheless, while it boasts numerous advantages, it's equally important to acknowledge the limitations and drawbacks that accompany this platform for a comprehensive assessment of its role in the Canadian crypto market.

Choosing the right platform for cryptocurrency trading is a deeply personal decision, dependent on individual needs, preferences, and risk tolerance. Newton serves as an excellent entry point for those stepping into the cryptosphere. Readers and potential users are encouraged to evaluate their specific trading objectives, weighing the strengths and weaknesses of different platforms. By considering personal needs and aligning them with the offerings of various exchanges, traders can make informed decisions that best suit their unique goals.

Disclaimer

There are substantial risks associated with trading and investing in securities or other financial instruments. Trading and investing in stocks, bonds, exchange traded funds, mutual funds, money market funds, and cryptocurrencies involves risk of loss. Loss of principal is possible. Some high risk investments or trading certain financial instruments may use leverage, which will accentuate gains & losses. Trading in foreign exchange ('Forex') on margin, as well as trading cryptocurrencies, entails particularly high risk and is not suitable for all people. Before you decide to trade or invest in foreign exchange, or any other financial market, you should carefully assess your objectives, experience, financial possibilities and willingness to take risks. Past performance is not an indication of future results!

Lastly, please note that the links to Newton on this page are affiliate links. If you use any of these links to register an account, you will get $25 CAD free if you make a trade over $100 CAD within 90 days of sign up. I only endorse Newton because of the positive experience I've personally had using the platform's products and services.