There are fundamental differences between ETH and BTC when it comes to their capabilities, intended use cases, and their respective ecosystems overall. I won't be discussing those in this post. I am merely using them as representatives for two radically different philosophies in the blockchain space, that of proof-of-stake and that of proof-of-work.

When we read about these things in mainstream news, on social media or any other space where these topics are being discussed, the primary consideration for one over the other is often cited as the environmental impact that they have - especially when it comes to power consumption.

There is no denying that a proof-of-stake blockchain has radically lower power requirements compared to a proof-of-work blockchain. Since the vast majority of power generated all over the world is currently not considered clean, sustainable energy, there is also no denying that at present a proof-of-stake blockchain will have a radically smaller energy footprint, and therefore much less of a negative environmental impact, than a proof-of-work blockchain.

However, in my opinion, while the above seems like a perfect argument to pivot towards proof-of-stake, it is also an extremely dangerous view that is both short-sighted and diverts attention away from a severe underlying issue with any proof-of-stake blockchain.

Mining ETH versus BTC

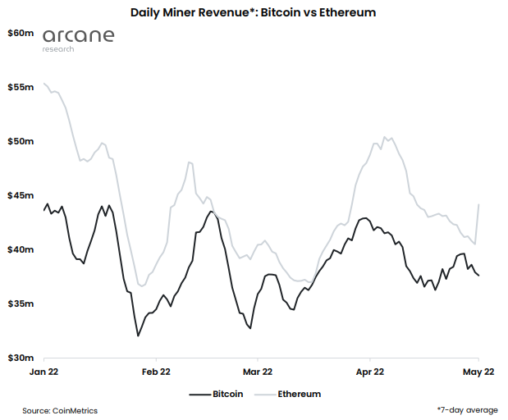

To understand the issue, first, let's take a small step back and look at why, especially recently, mining ETH has been more profitable than mining BTC.

The short answer is gas fees; they make up a significant amount of revenue for ETH miners but are largely insignificant for BTC miners. Ever since the NFT craze in late 2021 gas fees on ETH have skyrocketed and are often cited as one of the main issues of Ethereum when it comes to its viability in terms of mass adoption; you can read more about those scaling issues directly on the Ethereum website.

This video is a perfect landmark for when that NFT craze peaked in the mainstream.

This is what mining revenues recently looked like when comparing ETH and BTC. Mining ETH is still more profitable than mining BTC, despite the initial NFT craze having largely subsided.

The gas fees on Ethereum are still out of control and often make trading small amounts of ETH or low-value NFTs that live directly on the Ethereum blockchain prohibitively expensive, which in turn limits the overall potential and specific use cases of Ethereum. This is not a new or recent realization. In fact, to name two examples, it's the primary reason why Dapper Labs decided to build their own L1 blockchain Flow after their experience with Crypto Kitties on Ethereum - and the primary reason why L2 solutions and ZK-rollups like Immutable X exist.

Now add the negative environmental impacts, due to the escalating power demands of proof-of-work blockchains, on top of all of that and we have the perfect narrative for why proof-of-stake is supposedly the future of blockchain.

The Problem With Proof-of-Stake

In order to understand the issue, we first need to look at value creation, the foundation of every business and our capitalist society. The foundation of every business is to create and deliver value in an efficient enough manner so that it will generate a profit after cost. In the broadest terms possible, value is created through work. In scientific terms, entropy is reduced by investing energy, turning something that's chaotic and useless into something that is more useful to humans. In simple terms, you have to spend time and/or money in order to make money.

This is essentially the concept behind every proof-of-work blockchain, such as Bitcoin.

Institutional investing works very differently. Institutional investors are usually large market actors such as banks, mutual funds, pensions, and insurance companies that pool together funds on behalf of others and invest those funds in a variety of different financial instruments and asset classes. Those businesses do create value like any other - however, their investors don't, they just give them money to turn it into more money. The more money an investor will give to these institutions to invest into ETFs, mutual funds, crypto tokens, or similar assets, the more they will get in return. In other terms, the richer those investors already are, the richer they will get, without doing any work or spending any money.

This is essentially the concept behind every proof-of-stake blockchain, such as Ethereum will be.

One could say that there is nothing wrong with this, that's just how our society works, deal with it. I think that's a valid position to take, if being honest about it. However, the entire crypto scene has become a huge echo chamber about how blockchain, DAOs, decentralization, a free metaverse, and other buzzwords are going to be our salvation and the future of humankind; finally a way out of end-stage capitalism! The reality is that everything that is currently happening in the blockchain space is leading us into the exact opposite direction, the tokenization of everything, everything having some kind of precisely measurable monetary value associated with it, essentially capitalism on steroids. In the world of NFTs and blockchain, at least as it is being steered right now, you will be even less relevant than you already are if you're not already rich. If this future happens as it is being envisioned, it'll be the most extreme divide between the wealthy and the poor that has ever existed in the history of humankind. If put into the terms of a free-to-play video game, in the long run, all that's going to be left are the whales and the gold farmers.

Proof-of-Work is Not a Long-Term Issue

The current impact of the energy needs of proof-of-work blockchains is undeniable, even more so in these most recent times of international turmoil and war. However, I believe the right approach is not to get rid of proof-of-work as a concept, but to see this as an opportunity and argument to radically increase investments into clean and renewable energy sources.

Significant advances have already been made in the field of fusion energy. In a recent milestone at the LLNL, published this summer, researchers recorded a net-positive energy yield of more than 1.3 megajoules during only a few nanoseconds. For reference, that's enough clean energy to power a few thousand homes for a year. This is what we need to double down on.

Bitcoin and the proof-of-work concept were conceived with the Kardashev scale of civilization in mind, originally proposed by Soviet astronomer Nikolai Kardashev in 1964. Kardashev wondered about civilization, which he defines by its capacity to access energy, to maintain itself and to integrate information from its environment. I encourage you to read more about his ideas and how contemporary physicists expanded on it.

In this context, and by looking at those premises, it becomes clear how those ideas relate to a proof-of-work blockchain and Bitcoin specifically:

- Access to energy; an ever increasing amount is required based on how proof-of-work creates an ever increasing complexity to solve. Over a period of time, this automatically accounts for radical breakthroughs in our ability to access energy.

- Maintaining itself; the concept of decentralization, there is no single controlling entity or group of entities.

- Integrating information from the environment; the concept of immutable information being publicly accumulated and stored on the blockchain.

All of the above is also one of the main reasons why Bitcoin has now become lot more like a naturally occurring commodity rather than something that's human-made and maintained, even though it factually is.

These are the same reasons why I believe that it's a huge mistake to switch Ethereum to a proof-of-stake blockchain. It's the antithesis to those concepts - access to energy becomes access to capital, maintaining itself becomes maintained through the people with the most money, because all crypto tokens have monetary value. Besides, there are already solutions that fix all the everyday issues this change is supposedly solving, namely L2 networks and ZK-rollups. It's basically an unnecessary band-aid for Ethereum to work around the energy issue, with potentially devastating results.

I do believe there is a perfectly valid and important place for more commercially oriented blockchain projects like BNB, FLOW, SOL, IMX, and way too many others to create an exhaustive list, especially when it comes to addressing the everyday practical needs of projects building on top of them, but nothing like those should be the foundation on which we build our digital future.

The right solution would be to fix the underlying issue, specifically the current energy scarcity, reliance on fossil fuels and other non-renewable energy sources that pollute our environment. That's a solution that would benefit all of humankind, all of us that are currently around as well as all future generations - not just the richest 1%.

I realize these are lofty, maybe even idealist thoughts. Then again, people should at least be honest about what their end-game is with proof-of-stake; it's about maintaining control and keeping our current societal order intact in the upcoming digital age, and a +1 at that.