I am down 43.92$ / 4.4% after my first week (actually more like a week and a half) of Forex trading. I am quite happy with this, given that I am fully prepared to lose the full 1,000$ that I used to fund my account with.

Before I started trading, most of the general advice I came across usually

boiled down to:

- Learn as much as you can about how the market and trading works.

- Paper trade first, don't use a live account.

- Develop your own strategy that works for you.

- Document and refine this strategy.

- Once you are able to be consistently profitable, switch to live trading.

I now understand where this advice is coming from. I scoured the net for free

Forex tutorials and courses and took a couple of months to learn as much as I

could. At some point I started paper trading, to better understand some of the

concepts in those courses. I developed a trading plan and strategy based on a

couple of principles and indicators - primarily GMMA, Stochastic, RSI and a

few other moving averages. I researched brokers, platforms and chose one. Then

I continued with paper trading for another 2 weeks, mostly to familiarize

myself with various the trading platforms, mostly MT4.

It all made sense in theory.

However, I had a hunch that once I actually start trading live with real

money, things would be completely different; real emotions, fear, greed and

other factors are significantly more pronounced when real money is on the line

versus practicing in demo mode. I wanted to find out and that's exactly what

happened. All the concepts, strategies, plan, and so forth went out the window

the moment I had MT4 open with a live account...

There are a couple of things that didn't work, several of mistakes I made, but

fortunately also one key element of my strategy that did work exactly as

intended.

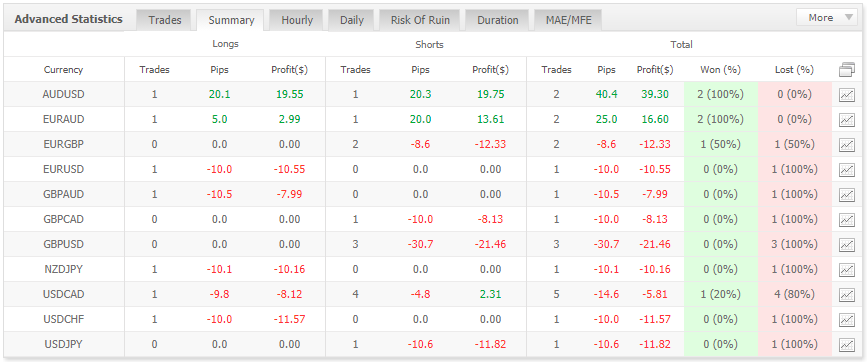

This is the overview of my first week, based on currency pairs:

I won 6 out of 21 trades, which represents 29%.

- AUDUSD and EURAUD were both great for me this week, both with 100% win rate.

- GBPUSD and USDCAD were both the worst, I lost 7 out of 8 trades on those pairs.

I also have all of this is publicly available on Myfxbook: https://www.myfxbook.com/members/rbnrch

Overall, my approach is to risk 1% of my account per trade to make 2%.

Meaning that with a balance of 1,000$, my default is to use 0.1 lots per

trade with a stop loss of 10 pips and a take profit of 20 pips.

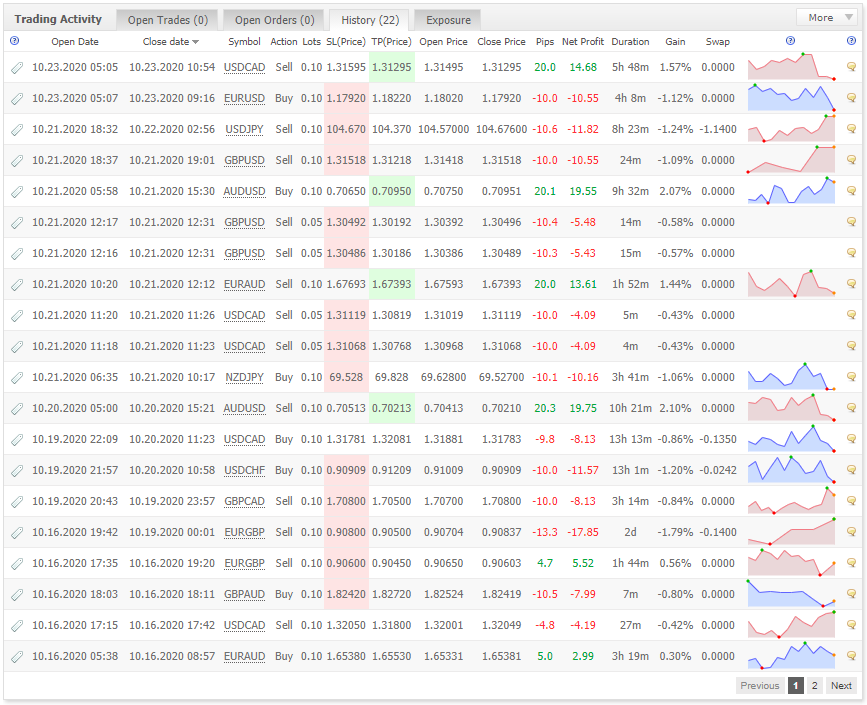

Here is the more detailed overview of all trades this week:

Some of the mistakes I made:

- I held a position over the weekend. This cost me 17.85$ / almost 1.8% of my account. It was a test in a sense and helpful to understand how the market can gap up or down significantly during off hours, which might trigger take profit or (like in this case) stop loss orders. It seems the same is true, to a lesser extent, when the trading day rolls over.

- I became greedy on some of the trades I was winning. I moved my take profit level in hopes of letting my profit run, just to see the trend reverse and miss out on my profit entirely. I do believe there is a time and place for this, but I will need a lot more practice and experience to distinguish legitimate opportunities from being greedy.

- I tried to liquidate half an open position. This worked fine, but it changed the lot size in the MT4 trading interface from 0.1 lots to 0.05 lots. Then, when entering a new position, I didn't pay attention and didn't change it back to 0.1 lots. Twice. In both cases, I opened another 0.05 lots position shortly after I realized this, but ended up loosing all 4 of those trades.

- I became fascinated by the market and started to be awake and trade all over the place in terms of my hours. Eventually I ended up moonlighting, starting my trading day at 5pm ET when the Sydney market opens, taking a look but mostly waiting until the Tokyo market opens at 7pm. Then taking a nap until 3am, when London opens to start trading for real. This is not going to be sustainable nor healthy, I definitely will have to find my rhythm eventually.

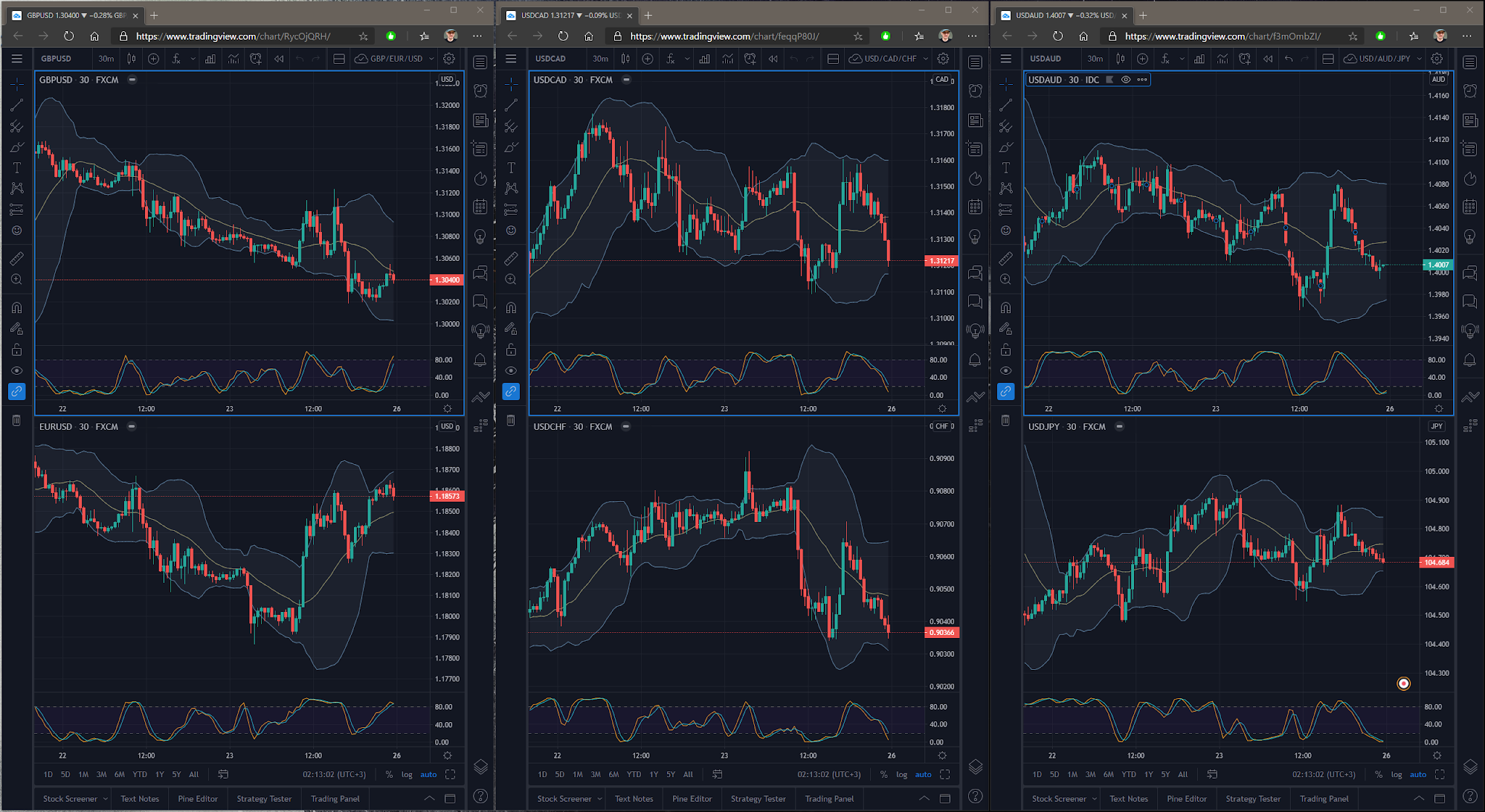

- For most of my trades I looked only at short term price action and didn't properly consider the bigger picture. I feel like that significantly contributed to my very low win percentage of 29%. In order to remedy this, I now opened an account with TradingView to constantly have certain charts open to better understand the overall trend:

These charts show Bollinger Bands over the last 2 days and have a Stochastic

over RSI indicator. Even though the data source of TradingView is different from that of my broker

Global Prime (which uses raw A-Book market data directly from their liquidity

providers) it's not much of an issue on these 30 minute charts. I found them

to be a good indicator to help me understand general, short-term market

conditions and to see when these major currency pairs are in overbought or

oversold territory. It would definitely be helpful to have a second monitor

for this, so that I don't have to minimize MT4 all the time to look at these

charts - that's something I will have to look into eventually.

No comments

Post a Comment