I traded a whole lot less this second week, compared to my first. I am down a couple of dollars compared to my first week, but no major change either way. Here is my full, public, verified track record.

This week was all about understanding proper position sizing.

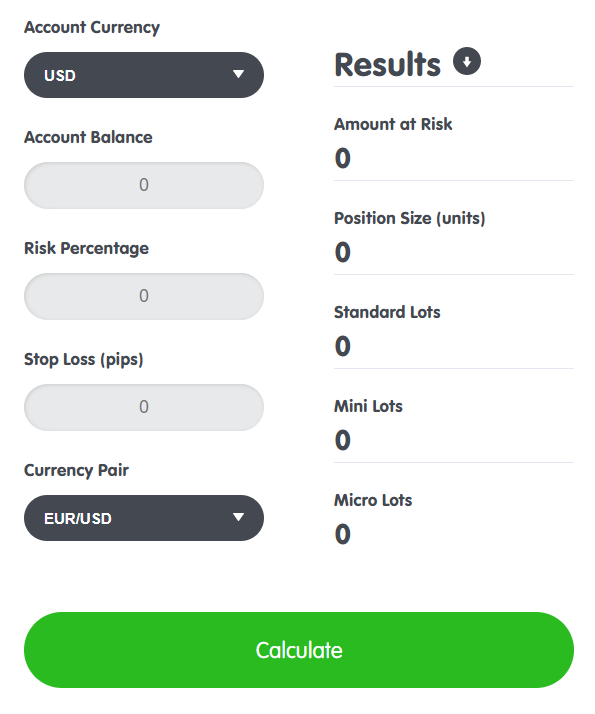

Before I started trading, I went through almost all of the material of the BabyPips FX trading course: https://www.babypips.com/learn/forex. There is a chapter on position sizing and they have a very straight forward and easy to use Position Size Calculator available:

When I was first reading through the course material, it kind of made sense to me in a way, but at the same time it didn't just based on the theory alone and without having ever used it in practice. I wasn't really sure when and how to properly use this calculator. So when I actually started trading, I totally forgot about this lesson altogether. With a 1000$ account and willing to risk 1% of it per trade (10 pips) to make 2% (20 pips), I always used 0.1 lots (i.e. one mini lot) as my position size. I assumed that this would essentially mean that I either lose 10$ or make 20$, plus/minus a few cent to account for broker commissions and slippage.

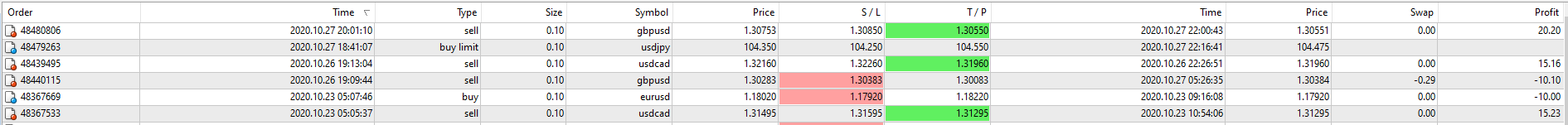

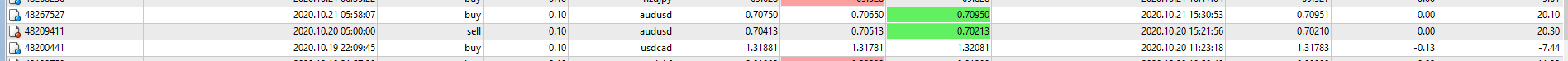

However, to my surprise, I often saw different types of profits/losses, while always using the same position size, and I didn't understand what was going on exactly. Here are some examples:

Fortunately, my broker Global Prime has a very active Discord community of traders willing to help. I posted these screenshots and asked for guidance to understand what's going on exactly. Somebody pointed me towards a short and sweet article about this on Investopedia. After reading through that, and now having the experience from actual trading, suddenly everything made sense!

I'm trading and learning directly on a live account. I think it is fair to say that this type of thing is one of the reasons it's highly recommended to start trading with a demo account instead. I don't disagree with that, but personally I find it makes me more likely to learn a lesson when it cost me real money - I'm seeing all of my mistakes as an investment into my future as a trader. My main strategy to mitigate losses and prevent me from losing my whole account in a matter of days is proper risk management. I'm currently not sure if my risk management strategy causes me to lose more trades than I should, but at least it's primary purpose of not blowing up my entire account is working so far.

No comments

Post a Comment